Residential real estate markets in desirable cities across the country have long been appreciating in value faster than real estate in the rest of the country. During the COVID-19 pandemic, that growth accelerated even more due to low supply and increased demand from the millennial generation. Even as interest rates rise today and the growth cools down, prices for housing remain high. As a result, buying a first home has become significantly more challenging for younger generations to achieve. Understandably, we’ve spoken to quite a few of our clients who have expressed an interest in helping their children and grandchildren buy a home. Here are questions we recommend you consider before you offer assistance.

Is there a maximum amount of funds that you would be willing to gift or loan to your loved one? The amount you are willing to give may not always be equal to the amount you are financially able to give, so it is important to talk to your financial advisor first to determine your ability to assist.

If you have additional children or grandchildren, do you plan to provide the same level of assistance when they are ready to buy a home? Most parents we speak to choose to give their children equal amounts. Of course, this also plays into the question above in terms of determining your financial capacity to give.

Now that you know what you’re willing and able to give, in what ways would you consider helping your loved one with the purchase? Below are five primary options. As you read through them, consider both the financial impact and, more importantly, the relationship impact between you and your loved one:

- Option A. Sole owner: You purchase the property yourselves and allow your child or grandchild to rent from you (or allow them to stay rent-free or below market). Maybe you even implement a rent-to-own strategy. If they decide to move out, you may either sell the property, maintain it as a second home, or rent it to the public. It’s important to note that this strategy does not enable your loved one to build credit.

- Option B. Co-owner of the real estate: You invest your money alongside your child or grandchild and the two of you jointly own the property. You would effectively be “going into business” with them, sharing in profits, losses, and risk exposure. In our experience, this option can create the largest strain on parent-child relationships.

- Option C. Gift money to them without an expectation of the gift being returned: You have no ownership in the real estate nor exposure to liabilities and you are irrevocably transferring a portion of your net worth to your child or grandchild. You can gift money to buy the property, or you can gift money to cover the mortgage (you can do this even if you choose to act as their lender; see Option D below). We have seen that this option can create the least strain on parent-child relationships.

- Option D. Act as your child or grandchild’s lender: You become the Parental Bank and loan your loved one the money they need to purchase the home. They would be responsible for making the mortgage payments to you. In the legal world, this is called an intra-family loan and you have the ability to set the interest rate ultra-low. This would be a formal debt with a secured promissory note (i.e., if your child stopped paying, you can take possession of the property). They can now be an all-cash buyer since you are fronting them the money. You could also build on this strategy by adding a gifting element (like Option C) and forgiving interest and/or principal over time. As your loved one’s income becomes larger and more stable in the future, they could refinance the loan with a traditional lender and pay you back in full.

- Option E. Co-sign a loan: Use your income to help your child or grandchild qualify for a larger mortgage. You become legally liable for the mortgage and if they are unable to pay, you must step in to cover the payments yourself. This loan would appear on your credit report and if payments are missed, your credit score would be negatively impacted. In this option, you are not fronting any money, so it has the least financial impact from that perspective. However, you are taking on risk by becoming legally liable for the mortgage without the possibility of any upside.

We are often asked which of the five options are best. Unfortunately, there is no one-size-fits-all answer. It depends on your goals and values, financial resources, risk tolerance, personal preferences, and family dynamics. What we can do is rank these options across several spectrums to help you hone in on the ideal option for you (please consider these to be general rules of thumb, as your experience may vary):

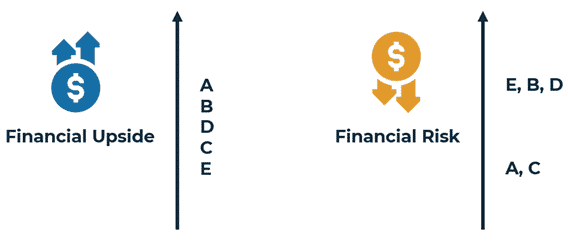

- Potential financial upside for you, largest to smallest: A, B, D, C, E

- Financial risk, biggest to smallest: While the nature of the risk is different, E, B, and D are grouped together on the high side, then A and C on the low side.

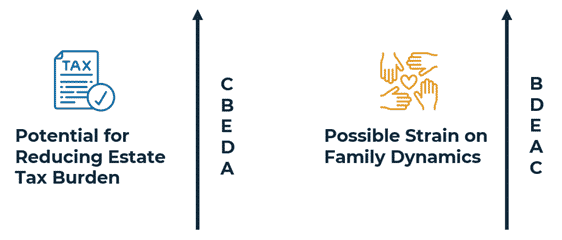

- Potential for reducing your estate tax burden, highest to lowest: C, B, E, D, A

- Possible strain on family dynamic, most to least: B, D, E, A, C

As you can see, there is a lot to consider before approaching a family member to discuss the possibility of financial assistance in buying a home. Beyond the financial implications for everyone involved, there are also the unique family dynamics to consider. If you’d like to have a conversation about assisting your child, grandchild, or another loved one in purchasing a home, please reach out to your advisor to discuss.