When starting out, knowing how to manage your money can feel daunting. In this post, we will offer simple steps to help you begin taking control of your financial life.

#1: Set Priorities and Goals

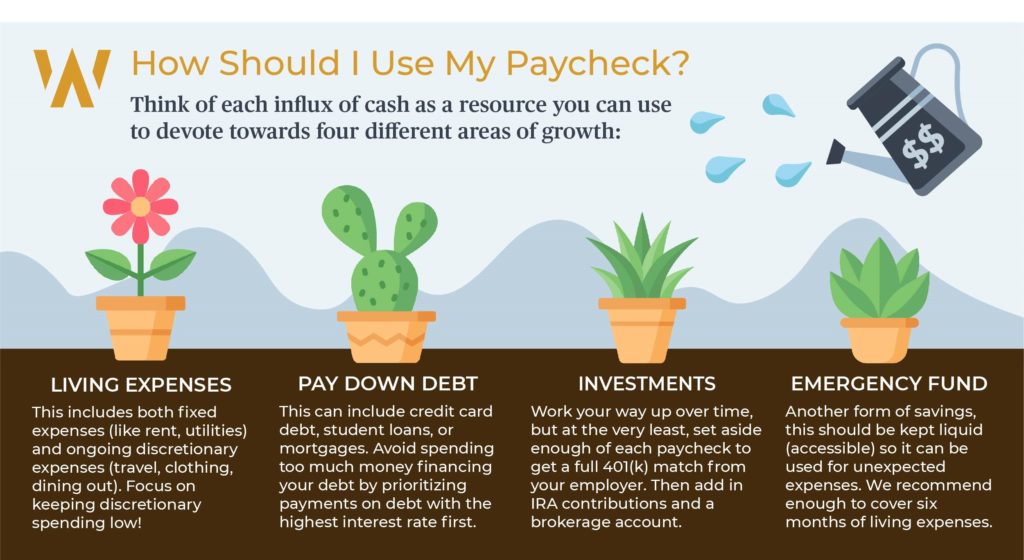

When you get your first paycheck, it is easy to want to spend it all right away, but what are all the things you should be putting your money toward with these limited resources?

- Automatically direct a portion of your paycheck to your separate savings account. Studies show that if you don’t see the money, it makes it a lot easier to save.

- You can direct this money to building your emergency fund, paying down debt, and adding to your investment account.

- Allocate a certain percentage of every paycheck rather than a flat amount. That way, the contribution will go up when you get a salary increase.

- Many apps and platforms exist to help you save even more frequently and in a smarter way. These apps can help you work towards your goals.

- Establish an emergency fund. A good rule of thumb is to have 6 months of living expenses set aside.

- Keep your emergency funds in money market accounts or no-penalty CDs so that you can earn interest while your funds are stored safely away. This is where the concept of liquidity (readily accessible cash) is important – depending on what you’re saving for, you may want to keep certain funds in a vehicle where you can access them quickly and without penalty.

#2: Build & Monitor a Budget

Creating and maintaining a budget is an essential part of financial health because it helps you set both limits and goals, stay on track with your savings, and monitor your expenses. To create a budget, we recommend focusing on the following:

- Calculate your monthly take home pay (after health insurance, taxes, retirement money). If you have more than one source of income, or receive irregular pay (i.e., bonuses, commission, etc.), you should also take that into account.

- Once you have your top line monthly income, you should gather a list of your fixed expenses, or the costs that stay the same each month (i.e., car insurance, rent, utilities, student loan payment, phone plan, and car payment).

- Next, estimate your monthly discretionary expenses, or the expenses that vary month-to-month (i.e., groceries, eating out, gas, travel, entertainment, buying clothes, and buying coffee).

- Subtract your fixed and discretionary expenses from your take home pay. This will tell you how much you have left at the end of the month (or overspend).

To help you come up with the best estimate for the numbers above, we recommend going through your past credit card/debit card statements and totaling up each type of expense.

Creating a budget is great, but it doesn’t mean much if you don’t continue to monitor your expenses each month. This can help you pinpoint areas in need of improvement, as well as locating ways to save more. For example, taking public transportation instead of calling an Uber, or making sure you are diligent about buying groceries instead of eating out frequently.

To guide you through this process, there are lots of budgeting platforms and tools out there, many of which are free and easy to use. You can also create your own spreadsheet in excel. Budgeting helps you become more cost-conscious and leads to finding more creative ways to save.

#3: Master Debt & Credit Management

Since debt is a common aspect of many young people’s financial life, sound cash flow management becomes even more important. When deciding whether to use your money to pay off debt or invest, consider the cost of debt and the current market environment.

Make sure you understand the concept of opportunity cost – money put towards one goal has a cost of not being applied elsewhere.

For example, if your student loan rate is 7%, the markets are returning 5%, and your mortgage is a fixed 3%, you should prioritize payments on the student loans and then consider investing in the markets, as it is expected to return more than the interest cost of your mortgage.

Next Steps & Advanced Planning Considerations

- Employer retirement programs. We always encourage participation in 401(k)s and other retirement plans to the greatest extent possible, as they are powerful tax-deferred savings vehicles that may include attractive company match programs. However, there is such a thing as over-allocating if it puts you in a bind and forces you to take actions we discourage, such as borrowing from the plan.

- Insurance. Analyzing insurance options on your own can be very confusing, and there is a sense of general distrust when it comes to dealing with insurance companies. But insurance is absolutely critical for some situations, particularly for young families. Many employers offer group benefits which can be a great place to start.

- Estate Planning. Estate planning is not just for the wealthy. Understanding what happens to you and your assets in situations of death or debilitation is very important.

How We Work with Someone Who is Just Starting Out

Developing strong financial skills as a young adult can set off a chain reaction. If you take a disciplined approach to your financial life, you can pay down debt faster and have more money set aside for investments. Once you have built up enough money to start investing, it is important to consider what method might be right for you. Due to the major technological innovations within the financial industry in recent years, low-cost digital planning solutions are more accessible than ever. We launched Wealthspire Pathways, an offering of this nature, to enable us to provide our fundamental services for a competitive fee to clients who are tech-friendly and planning-focused.

Regardless of the investing path you choose, the earlier you begin to put money away in savings and investments, the more growth potential lies ahead. All in all, these principles of money management should make for a bright future built upon knowledge, healthy financial habits, and confidence in your ability to be the steward of your own wealth.

For further reading we recommend “The Millionaire Next Door,” which points out that the truly wealthy are not the ones who live lavish lifestyles, but the ones who live right next door, drive used cars, and save and invest their wealth.