Estate Planning in Light of Current Law: Your Questions and Our Answers – 2024 Update

This post will help you consider estate planning strategies in light of the current federal estate, gift and generation skipping ...

Basics of Federal Estate, Gift, and Generation-Skipping Transfer (“GST”) Tax – 2024 Update

The bad news is that there is a federal transfer tax on assets that you give away during life, at ...

Mitigate New York’s Estate Tax Cliff with Smart Estate Planning and Gifting Strategies – 2024 Update

While the large increase in the federal estate tax exemption has provided many with federal estate tax relief, New Yorkers ...

2024 Federal & State Estate and Gift Tax Cheat Sheet

Here we have provided a “cheat sheet” to keep in mind for 2024 federal estate, gift, and GST exemptions, as ...

Understanding New York’s Estate Tax “Cliff” – 2024 Update

In 2014, dramatic changes were made to New York’s gift and estate tax law. For many clients, the subject of ...

Spousal Lifetime Access Trusts (SLATs): FAQs – 2024 Update

What is a Spousal Lifetime Access Trust (SLAT)? It is a trust that you (the grantor) set up for the ...

Special Needs Planning: Schools, Trusts, & Beyond

In partnership with Special Education Legal Fund, Wealthspire’s Michael Delgass and Richard Yam were joined by special education attorneys Adrienne ...

Special Needs Planning – FAQs

Having a comprehensive estate plan in place is important for everyone, regardless of your personal family life, and can cover ...

5 Planning Steps to Consider Before Year-End 2022

As summer ends and we look toward the Fall, you should aim to maximize your opportunities to transfer wealth to ...

Incomplete Non-Grantor (ING) Trusts – FAQs

What is an Incomplete Non-Grantor (ING) Trust? An ING trust is a trust you set up in which assets you ...

Tax Proposals: Big Changes to Come

On November 3, the House Rules Committee updated the October 28 revised reconciliation bill for the Build Back Better Act – H.R. ...

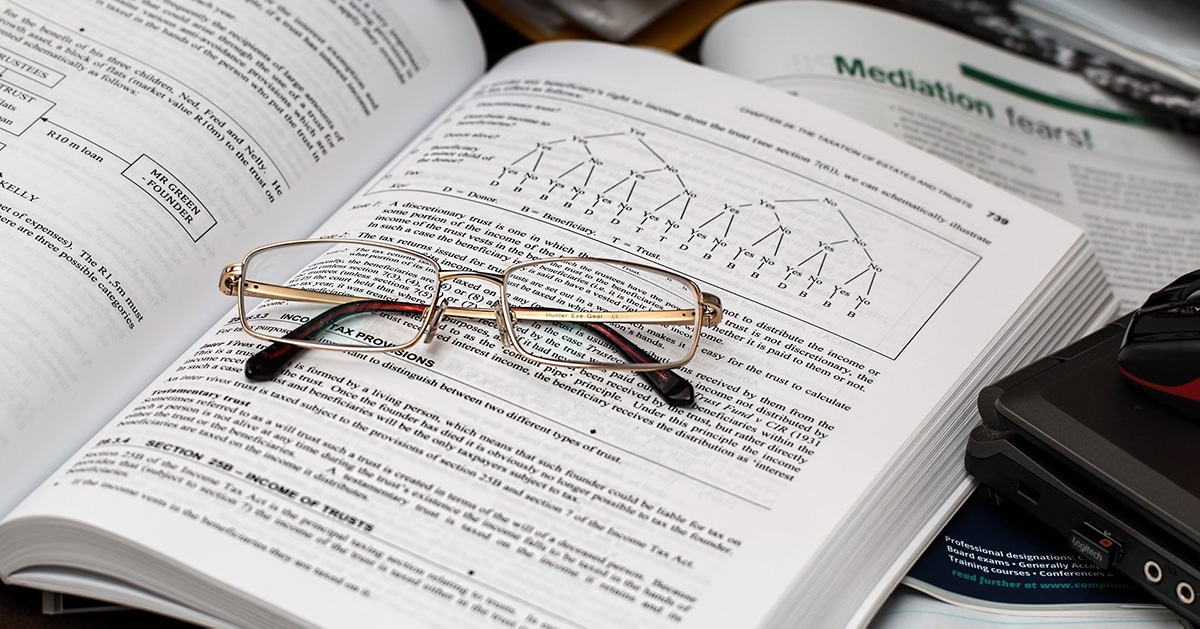

How Are Trusts Taxed? FAQs

With the tax season fast approaching, you may have questions about how your trust is taxed, who is responsible for ...