How Savvy Investors Plan for Education Expenses

There is a changing reality for many parents – advanced planning and a long-term strategy for financing a child’s education ...

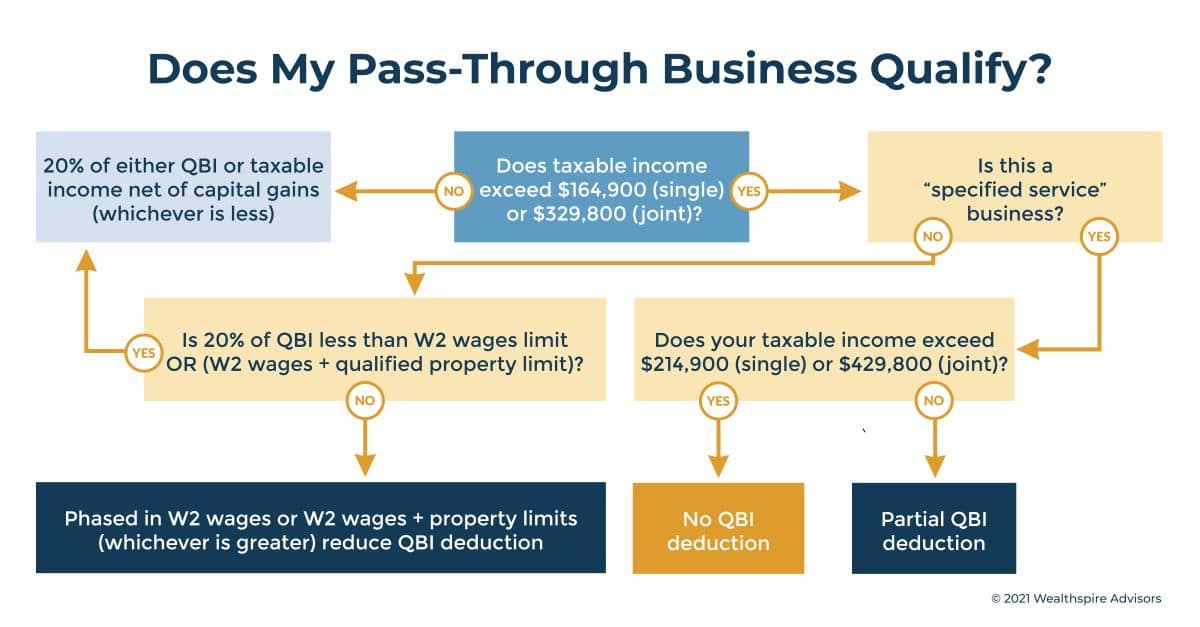

Qualified Business Income (QBI): Deduction May Create New Planning Strategies for Some Business Owners

The Tax Cuts and Jobs Act of 2017 introduced a 20% tax deduction focused on pass-through businesses. While the deduction ...

Talking About Money: Navigating Wealth Transfers Across Generations

As financial advisors, we have the privilege of working with numerous families, witnessing their triumphs, heartbreaks, milestones, and life transitions. ...

Wealth Transfer: Destigmatizing Money Conversations

Wealthspire hosted a virtual event for families that focused on having honest, meaningful conversations that removes the stigma of talking ...

Empowering Athlete Families During the Early Years

The early years of a successful athlete’s career are a thrilling time for both the athlete and their families. Change ...

Financial Check-Ups: Monthly Activities to Help You on Your Financial Journey

As you continue on through what has hopefully been an exciting start to the year, it’s important to check in ...

Paycheck Protection Program (PPP) and Employee Retention Credit (ERC) Updates

There has been an almost constant buzz over the past few weeks concerning various stimulus packages and potential tax code ...